Buy your way out of a 9-5

and get someone else to pay for it

Intro

$5.1 Trillion in small businesses are owned by retirement-age baby boomers. These boomers are about to transfer more wealth than any generation before it, but the question is, how can we position ourselves to gain from this?

As time is going by, the "boomer generation" are retiring at a higher rate. What does this mean for you? Where do you think those businesses that are owned by the older generation go. Yes, a portion are passed down through family, but even this is becoming fewer and far between as youngsters are choosing other career paths.

Reasons to buy a business?

1. I have learned the hard way that I don’t want to do the hard work of starting a successful company. I like growing a company from level 2 - level 10 and not level 0 to level 1.

8 out of ten start-up businesses don’t survive past 5 years, and 9 out of 10 of the ones that do survive past 5 years don’t survive past 10 years. This means you can buy an already established business, that stood the test of time, and will potentially be cheaper and quicker than you growing a business for 10 years

Less than 20% of all businesses that are marketed for sale are actually sold - meaning you will have strong leverage when constructing a deal, and be spoilt for choice.

Opportunity to buy assets at a tax efficient rate. More on this later

The cash on cash return is usually higher than most stocks investments

Reasons against buying a business?

1. It's hard work, it's simple but it is work. In the future you can create a holding company that holds all your companies and your companies will work for you and you won't work for them but in the beginning this won't be the case.

2. The higher the return usually means the higher the risk of losing your initial investment. Especially if you don't choose the right business.

What type of businesses should you go for?

Depending on country (how the environment effects whats profitable) will depend on what type of company you should go for. I think that you should always go for a business that you have some experience in so that you understand a lot of the basics of how that particular type of business is run prior to purchasing a company. I have done some research into what the most profitable small businesses in the UK are and according to SmallBusinessPro:

a. Couriers

b. Coffee Shops

c. Car Washes

d. Catering Companies

e. Internet-based Companies

f. Landscaping

g. Food Delivery & Restaurants

h. Sandwich Bars

i. Manned Van Services

j. Professional Services like Accountants, etc.

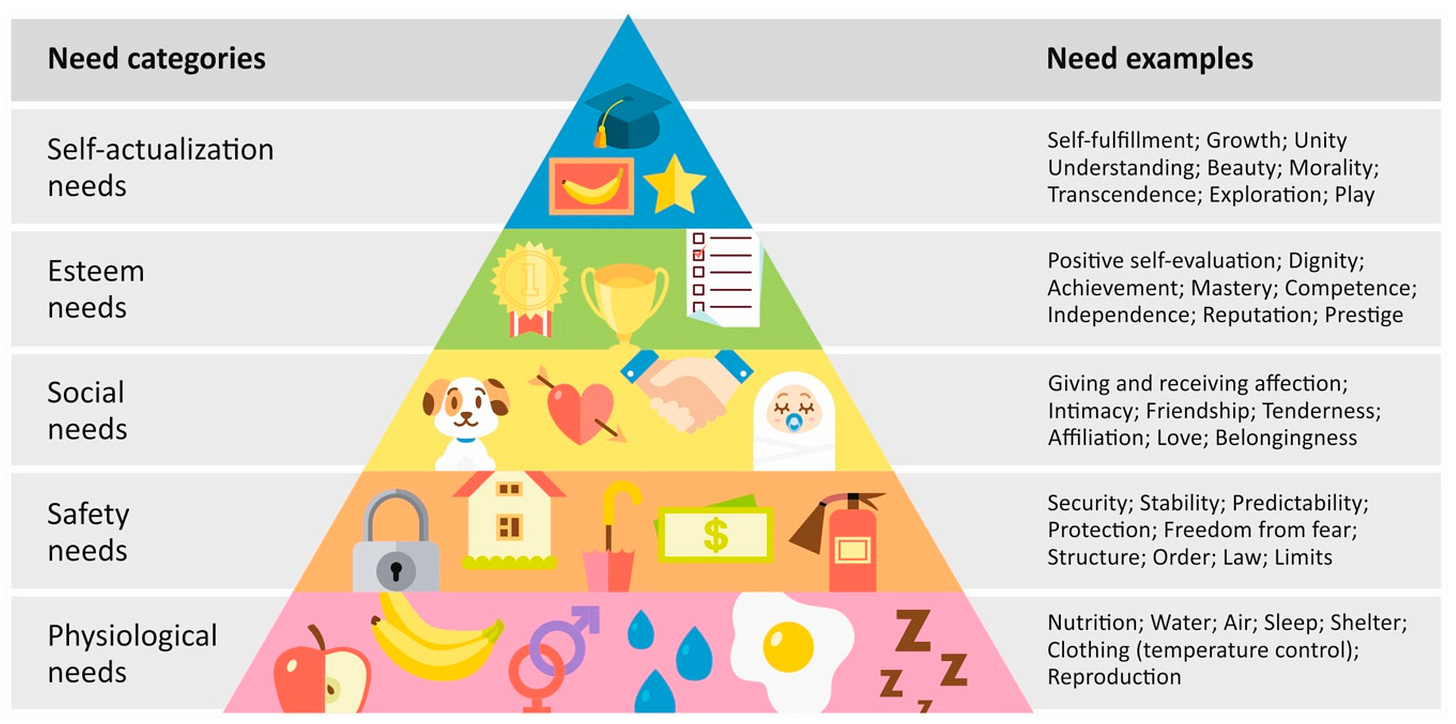

Another thing to look out for is a business that satisfies one of Maslows Hirachy of needs.

Maslow's hierarchy of needs is a framework that organizes human needs into a pyramid-like structure. At the base of the pyramid are physiological needs like food, water, and shelter. Moving up, the next level encompasses safety needs such as personal security and stability. As each level is satisfied, individuals progress towards fulfilling the needs at the next level, ultimately striving for self-actualization. A business that satisfies a number of these is the property industry, from esteem needs to safety needs.

Where to find businesses for sale?

There are multiple websites and brokers all over the world that sell businesses. However the best deals are usually done direct with the owner. Some websites the owner will directly publish their companies on websites such as

https://uk.businessesforsale.com/uk/search/businesses-for-sale

Or

https://flippa.com/

Pro Tip:

You can learn a lot and pick the brain of some of the established business owners in your area and get insight on how they think and solve problems.

How to fund it for little/no money?

4 ways to finance a business.

• SBA - Small business association

The government will give you 90% of the price of the business to buy it. There is a personal guarantee element to it like a mortgage but they look into the businesses financial health and not so much yours which makes it easier

• SF - Seller financing

You pay the seller from the future profits of the business to buy the business (aka I will pay you x as long as the company does x over x years ). Why would someone do this? 60% of all business deals done in small business land is done with seller financing. This is done for a various number of reasons but my favourite is retirement.

• Investors - most expensive

• Your own money - the most risky as you are liable regardless

How to structure a deal?

You can either have my price and your terms or your terms and my price. Controlling the terms is everything when constructing a deal. In property there is not that many terms you can play with but with buying a business you can have fun with it and be as creative as you can to create a win-win situation.

Pro tip: "If you control the terms you control the price" - Codie Sanchez

Extra info:

All you need is a lawyer - negotiate by saying per deal transaction and not any of this hourly stuff. The hardest thing is starting, but once you start its simple to get your head around.

Summary:

The first deal is the most important. All I do is look for old businesses (7+ years) for 2-3x the yearly profit, in recession resistant sectors. Find something you understand and can improve.