I didn't quit my job - But I Built £3,000/Monthly in Passive Income Anyways

In a world where every penny counts and time is the one thing you can’t get back, learning how to make your money work harder than you do is everything.

For years, I paid my bills, tossed a token amount into savings (mainly for emotional comfort), and blew the rest in three days. I used to say, “I lived like a king for those three days.” And that was true… if kings also stressed about direct debits and overdrafts for the other 27 days.

Then one day, a quote from The Richest Man in Babylon finally landed:

“A portion of all you earn is yours to keep.”

It hit me—I wasn’t keeping anything. That was the beginning of my financial turning point.

Step 1: Stop the Bleeding

I didn’t need to be a financial genius—I just had to stop being financially reckless.

My wife helped me with my first spreadsheet. I started budgeting (painful at first), tracking where my money was going, and learning how to say no to buying that 3rd coffee in the shift. Small changes, big difference.

Step 2: Make Your Expenses Work for You

Back then, my biggest liability? Rent.

I lived in London, where £1,000 a month gets you a studio with a broken boiler and a strong smell of curry from three floors down. Then COVID hit. Everyone panicked—but we saw an opportunity.

As Warren Buffett says:

“Be fearful when others are greedy, and greedy when others are fearful.”

We weren’t high earners by any means, but we were strategic. We found a way to buy a £300,000, two-bedroom property with just £1,500 of our own money. No magic. Just clever use of the system and some serious graft.

(If you’re curious how we pulled that off, click here.)

Our mortgage payments were now going towards an asset—not a landlord's next holiday. Over time, it felt like we’d created a glorified low-access savings account... with windows.

Step 3: I Made Money Watching Movies (No Joke)

After the property win, I realized I still didn’t have the freedom I wanted. My income was active, I had to trade time for money.

So I got brutal with how I used my time. If I wasn’t:

Earning,

Learning, or

Moving my body...

...then I was wasting time.

Turns out I could monetise things I enjoyed. I loved movies—so I became an extra. (Still waiting on my Oscar, but I looked great walking behind the main actor.)

Basketball with friends became my fitness plan (shame about my diet though). Property events replaced nights out—my version of fun changed to aligning with my goals. Social media and books became my university. It wasn’t easy, but it made progress feel inevitable.

Eventually, that constant learning landed me my first six-figure deal. And the same discipline helped me get better at work, which meant more money from my 9-5 too.

Step 4: Income Up, Pressure Down

My wife? She quadrupled her income in a few years. Me? I levelled up too. [Click here to see how she did it.]

We were earning well, but here’s the thing: it was all still active income. One bad year and things could tumble.

So I applied the same mindset I had when investigating serious crimes—I went deep into due diligence, looking for safe, passive income options. But I had high standards. I wanted investments that were:

Low risk

Somewhat liquid

Sharia-compliant

Long history of providing results

And actually worth the time

Spoiler: not easy to find.

So just before our son was born, we sold our house and moved in with my parents. Not for the faint of heart, but it helped lower expenses even further and gave us more support (it really does take a village) .. also, free childcare anyone?

Step 5: (2023) Investing in Labour… During Labour

While my wife was in labour (five long days), we got talking about a deal. Priorities, right?

My cousin, a veteran in the property game, told me about a Managed Real Estate (MRE) opportunity he was promoting. He'd been in the industry for 15+ years and wanted us to invest. We trialed one unit (we pulled the trigger whilst my wife was in labour). Let it run quietly in the background.

A few months in, we saw it was working. So we bought a second unit.

Eventually, we understood the security behind it. That’s when we shared the opportunity with friends. Now, I was happy to do it for free, but my cousin insisted I get a cut. Lesson?

If opportunity knocks, don’t just answer the door—negotiate rent.

I made sure the deal was structured so everyone won:

My cousin made money.

The investor made solid returns.

And I earned commission, without compromising on ethics

The demand blew up. Suddenly, I had limited stock, too many interested investors, and a product that only ran for five years (which is passive… but not forever).

We leveraged borrowed funds to expand, since the returns were higher than the cost of borrowing from the banks. And to sweeten the deal, we structured it so that if landlords renewed leases, returns could last longer than five years.

Step 6: Baby, Cat, One Way Ticket to Dubai

Because clearly, life wasn’t chaotic enough.

We sold everything and moved to Dubai—no job lined up, a baby, and a cat that absolutely did not enjoy the flight. Classic move.

Somehow, I landed a job as an estate agent and ended up buying a one-bed apartment in cash (we somehow made it work). We rented it out, and soon after, found out we were expecting baby #2.

We came back to London, a little sunburnt, a little exhausted, and with a whole new story.

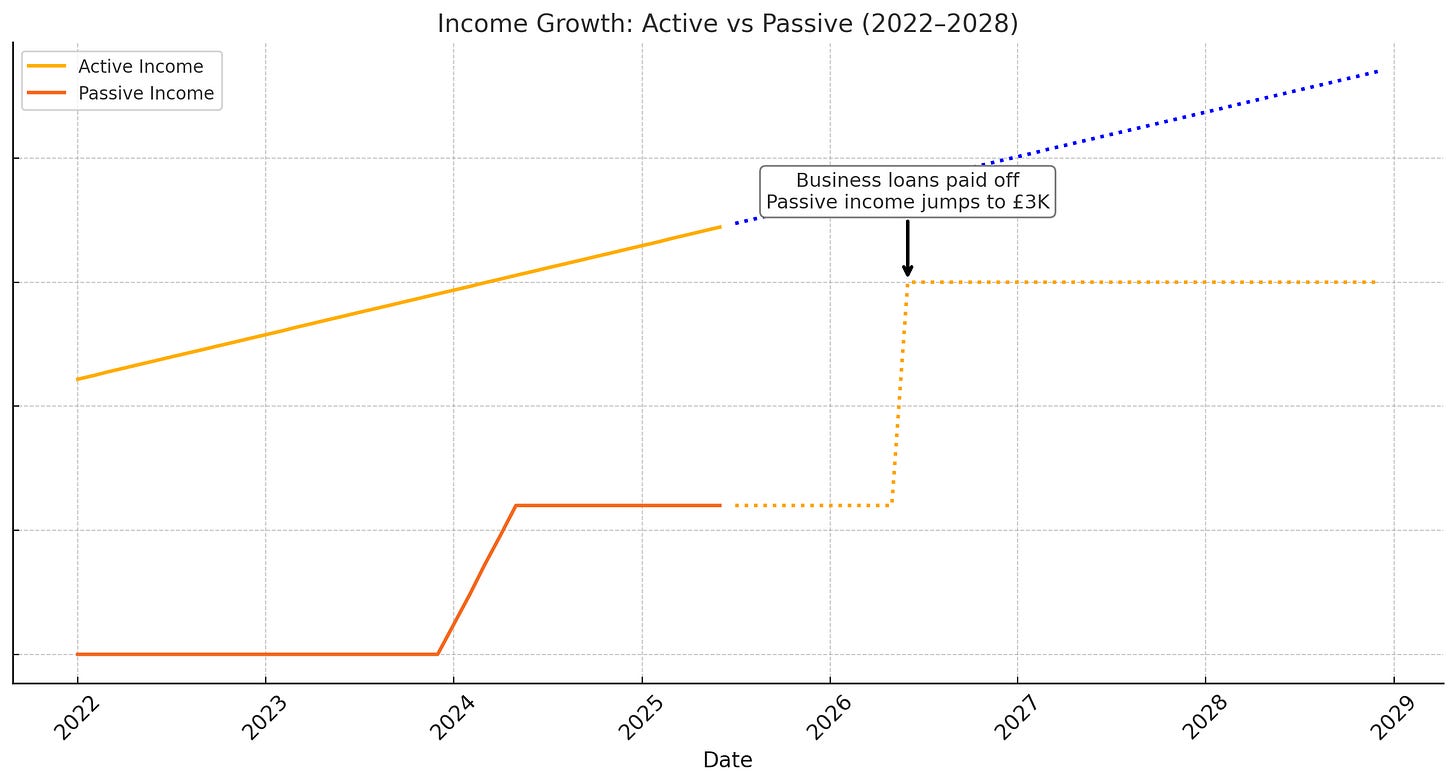

Even if we don't take on anything new, we're locked into £1,195/month in passive income until Sept 2026. Once the leveraged deals are paid off, that figure jumps to £2,975/month. Not forever—just a two-year run—but enough to trigger my goal of:

Part-time retirement – taking a year off to travel and be present with my growing family without touching our savings.

Summary: Financial Freedom on a Deadline

We pulled this off in just 18 months—through resourcefulness, calculated risks, and a lot of late-night budgeting sessions. No silver spoon. No secret funding. Just taking small steps and making the best of what we had.

I’m a regular guy who likes breaking complex problems into manageable actions.

Not everything has been smooth, but by:

Investing in assets, not liabilities,

Learning consistently,

Monetizing what I already enjoyed, and

Saying yes to opportunities that aligned with my values...

...we’ve reached a temporary but powerful financial position.

£2,975/month passive income. A full 2 years off work without touching our savings. Quality time with my family.

And that, for me, is what success looks like.

Let me know if you'd like a breakdown of the tools, strategies or how we structured our deals. Or even just a motivational voice note when you're ready to jump into your own version of this.